When it comes to trading in the forex market, understanding the primexbt forex spread https://www.review-primexbt.com/ is essential for both novice and experienced traders alike. The spread is a fundamental concept in forex trading that plays a crucial role in determining the overall cost of a trade. In this article, we will dive deep into what the forex spread is, how it works on platforms like Primexbt, and the strategies you can use to optimize your trading outcomes.

What is a Forex Spread?

The forex spread is the difference between the bid price and the ask price of a currency pair. This difference represents the cost of trading and is a crucial component in a trader’s decision-making process. The bid price is the price at which the trader can sell the currency pair, whereas the ask price is the price at which they can buy it. The wider the spread, the more a trader pays to enter a position, which can significantly affect profitability, especially in short-term trading scenarios.

Types of Forex Spreads

In the world of forex trading, there are primarily two types of spreads: fixed and variable (or floating) spreads.

Fixed Spreads

Fixed spreads remain constant regardless of market conditions. They are predetermined by the broker and can offer traders certainty regarding their trading costs. This can be particularly advantageous during high-volatility events, as traders can avoid sudden spike spreads.

Variable Spreads

Variable spreads, on the other hand, fluctuate based on market conditions. During periods of high volatility, spreads may widen, which can increase the trading costs unexpectedly. Traders need to be aware of these changes and adjust their strategies accordingly.

How Primexbt Handles Forex Spreads

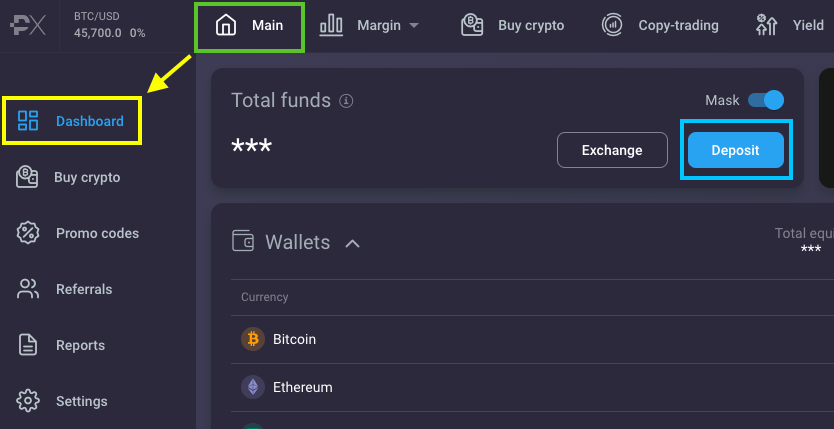

Primexbt is a trading platform that has gained significant popularity among traders for its unique features and competitive spread offerings. Understanding how Primexbt manages forex spreads can help traders make informed decisions when utilizing this platform.

Competitive Spreads

One of the main advantages of trading on Primexbt is the competitive spreads offered across various currency pairs. The platform utilizes cutting-edge technology to provide traders with spreads that are often more attractive compared to traditional forex brokers. This aspect is vital for traders who are looking to maximize their profitability.

Real-Time Market Data

Primexbt provides real-time market data, allowing traders to see live spreads as they fluctuate. This transparency enables traders to make timely decisions based on the current market environment, enhancing their overall trading experience. The access to real-time data also helps in better risk management and strategy formulation.

Factors Affecting Forex Spreads

Several factors can influence the forex spread, and being aware of these can help traders navigate the market more effectively.

Market Liquidity

Liquidity refers to the ease with which a currency pair can be bought or sold without causing a significant impact on its price. Highly liquid currency pairs, such as the EUR/USD, tend to have narrower spreads due to the high volume of trades occurring. In contrast, less liquid pairs may exhibit wider spreads.

Economic Indicators

Economic events, reports, and news can cause fluctuations in spreads as they often lead to increased volatility. Traders should stay updated with the economic calendar to anticipate these events and how they may impact spreads.

Broker’s Pricing Model

Different brokers adopt various pricing models, which can affect the spreads they offer. Understanding whether your broker operates on a market maker or an STP (straight-through processing) model can give you insight into how they determine their spreads.

Strategies to Optimize Trading Costs

To optimize trading costs associated with spreads, traders can implement several strategies:

Choose the Right Currency Pairs

Opting for currency pairs with tighter spreads can significantly reduce trading costs. Focus on major pairs like EUR/USD, GBP/USD, or USD/JPY, which tend to offer more favorable spreads.

Trade During Peak Hours

Trading during peak market hours when liquidity is high can result in tighter spreads. The forex market is most active when major financial centers overlap, typically between 8 AM and 12 PM GMT.

Use a Broker with Low Spreads

Choosing a broker like Primexbt, known for competitive spreads, can lead to better overall trading performance. Compare the spreads offered by different brokers, and ensure you choose one that aligns with your trading strategies.

Conclusion

Understanding and managing the primexbt forex spread is pivotal for traders looking to enhance their trading performance. By being aware of how spreads work, the factors influencing them, and employing effective strategies, traders can significantly reduce their trading costs and potentially increase their profitability. As you navigate the forex market, always remember that knowledge and strategy are your best allies in trading.